HR Services

The Human Resources Division provides a range of operational, advisory and strategic services that enable the University to attract, develop and retain outstanding staff who are committed to the achievement of excellence and to the values of the University.

Human Resources Strategic Plan

How we work with you

It's important to us that we can deliver high-quality, responsive and effective services. To do this, we work collaboratively with you to foster an environment where people feel valued and can do their best work.

Human Resources support staff and managers across the University’s colleges and divisions by providing effective valued, consistent and responsive people solutions that enable the University's strategy and goals

HR Services provides the following:

Human Resources Intranet (Staff Only)

If you have a query about any aspect of HR Services, please contact the HR Assist team via:

University Contacts

Payroll, Payslips, Leave and Timesheets

Collective Agreement and Policies

Staff ID Card and Access

All new employees can acquire a new staff ID card by completing an online form once you have been setup on MyHR.

Once you have obtained your ID card you will need to complete the Access Request Form and provide details of where access is required.

Request for Recognition of Prior Service

The University will recognise prior service for the purposes of Long Service leave and Personal leave entitlements, if an employee commences employment with the University on a non-casual basis immediately after a period of employment with a "relevant public institution" (as defined below). The University will recognise prior employment with a relevant public institution as follows:

- Australian Higher Education institutions

- TAFE Providers

- La Trobe Student Association

- Public Hospitals

- Public Service of the State of Victoria or Commonwealth including their instrumentalities and bodies with which these entities have reciprocal arrangements.

Application:

Please provide the attached form (Request for Recognition of Prior Service) to your previous employer as soon as possible after commencement. Once the form is completed and returned to you, please attach to your on-boarding documentation or alternatively, lodge it through AskHR, This form must be lodged within the mandatory 12 month period.

Single Touch Payroll (STP)

Single Touch Payroll is a legislative change to the way employers report their employees' tax and super information to the ATO.

What has changed with Single Touch Payroll (STP)?

How it worked before STP

- Your fortnightly payslip is available in the MyHR

- Your payment summary information is available in the MyHR at the end of the financial year

- You can access your tax information at the end of the financial year via myGov if you have the ATO linked in your myGov account

- Your registered tax agent has access to your tax information at the end of the financial year

How it works now STP has been implemented

- Your fortnightly payslip will still be available in the MyHR

- Your payment summary information for financial year 2018/2019 will no longer be available in MyHR at the end of the financial year. However historical payment summary information will still be available in the MyHR

- Your payment summary information will be called an 'income statement' in your myGov account. The ATO will send a notification to your myGov inbox when your income statement is ‘tax ready’ so you or your tax agent can complete your tax return

- Each time we pay you, your year-to-date tax and superannuation information will be communicated to the ATO

- Your registered tax agent will also be able to access your STP information

How do I set up a MyGov account and link it to the ATO?

How do I access my income statement (previously called payment summary/group certificate)?

Refer to the ATO website.

Follow these instructions once your myGov account is set up and linked to ATO online services:

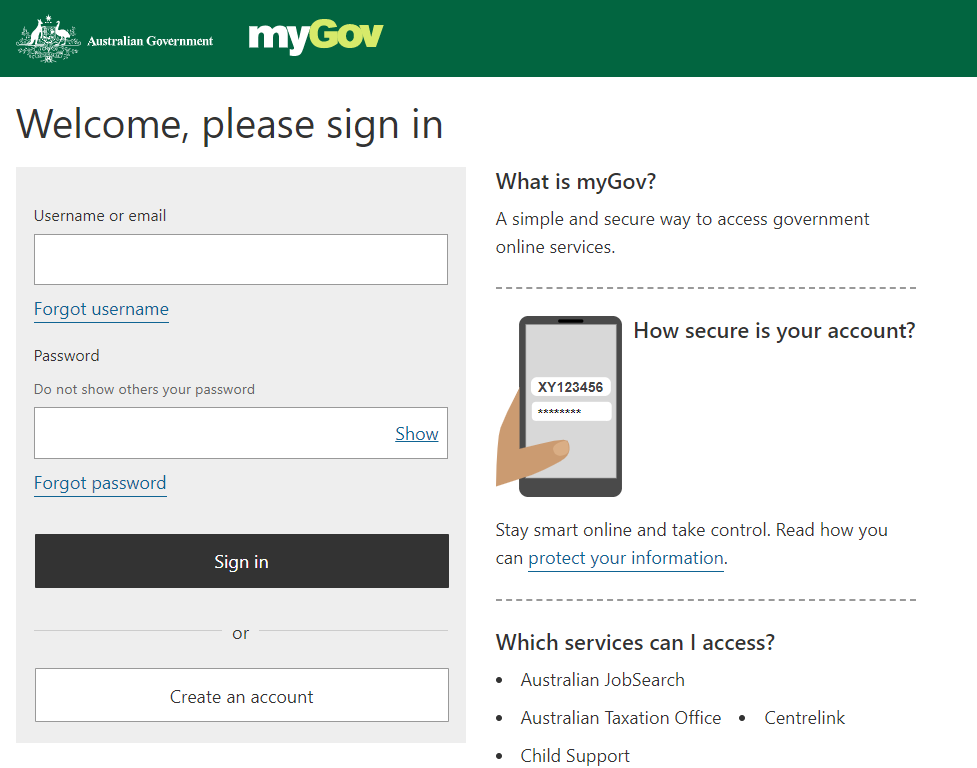

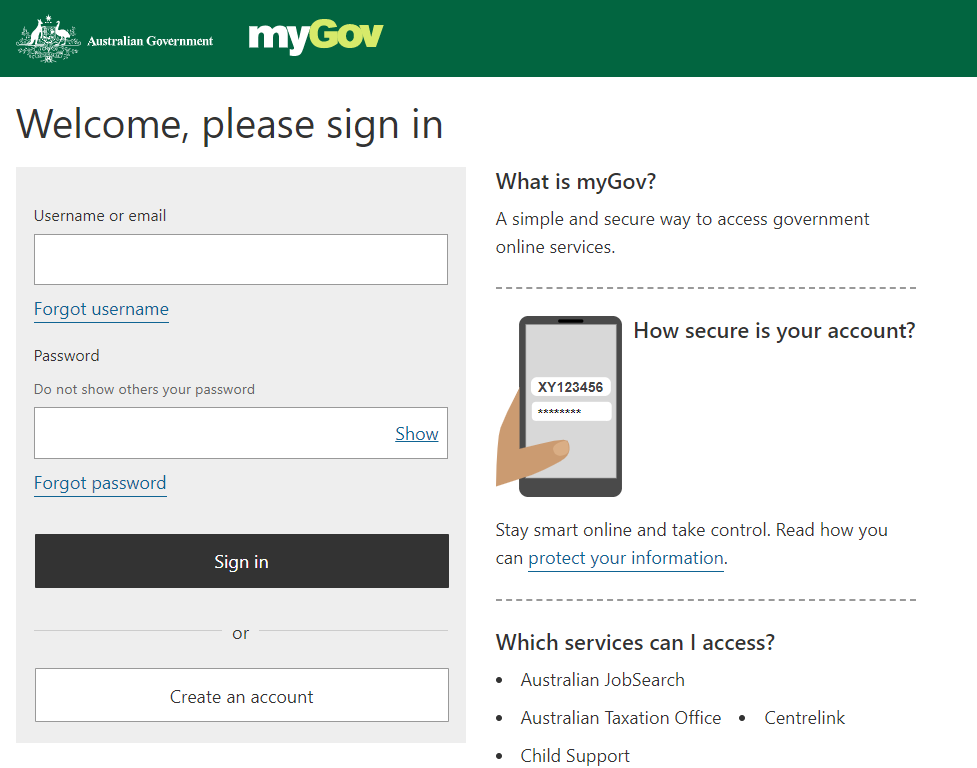

Log in to myGov using your email address and mobile phone number

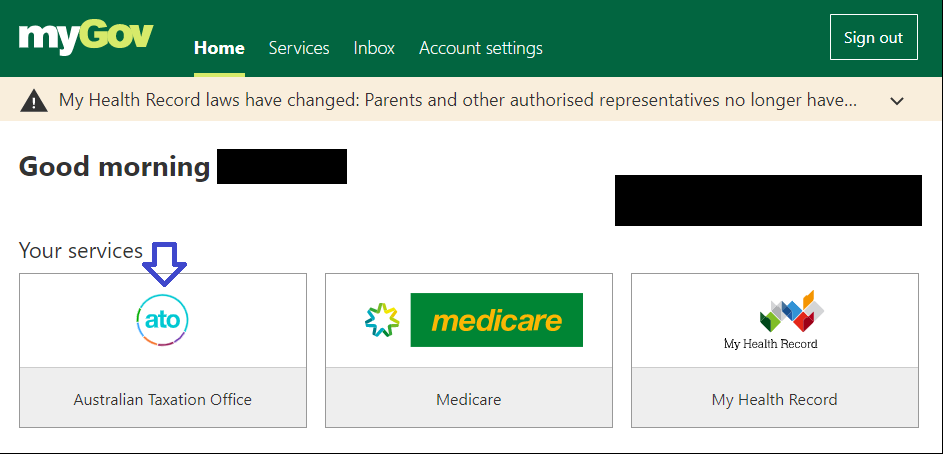

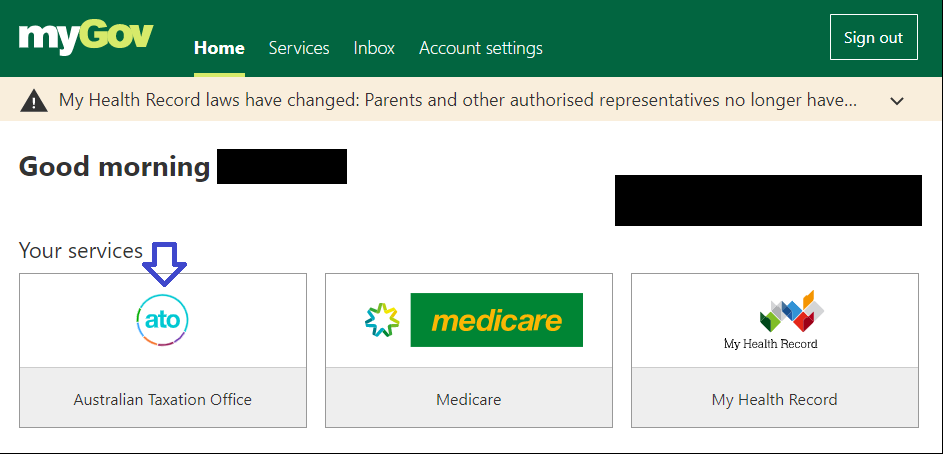

Select ATO online services

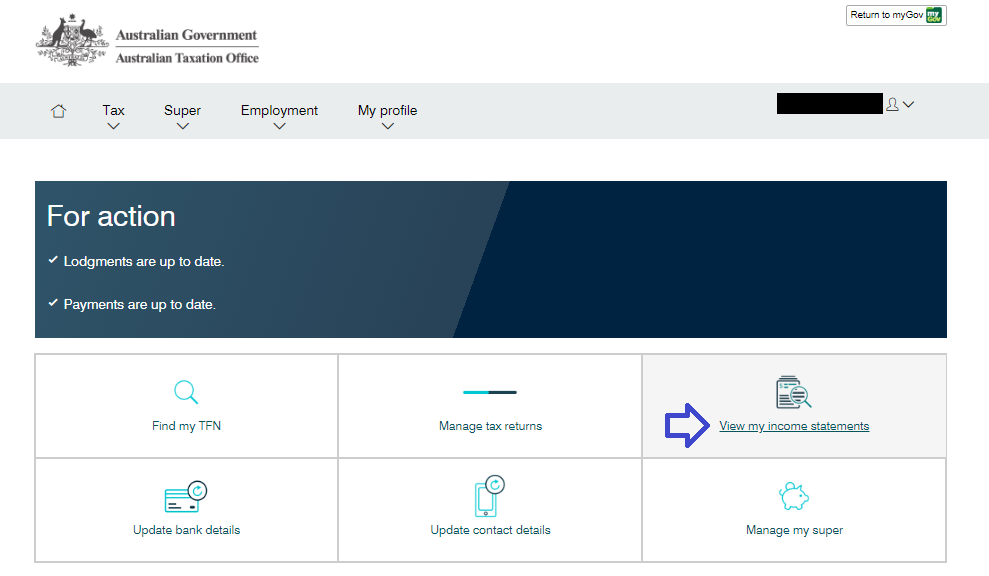

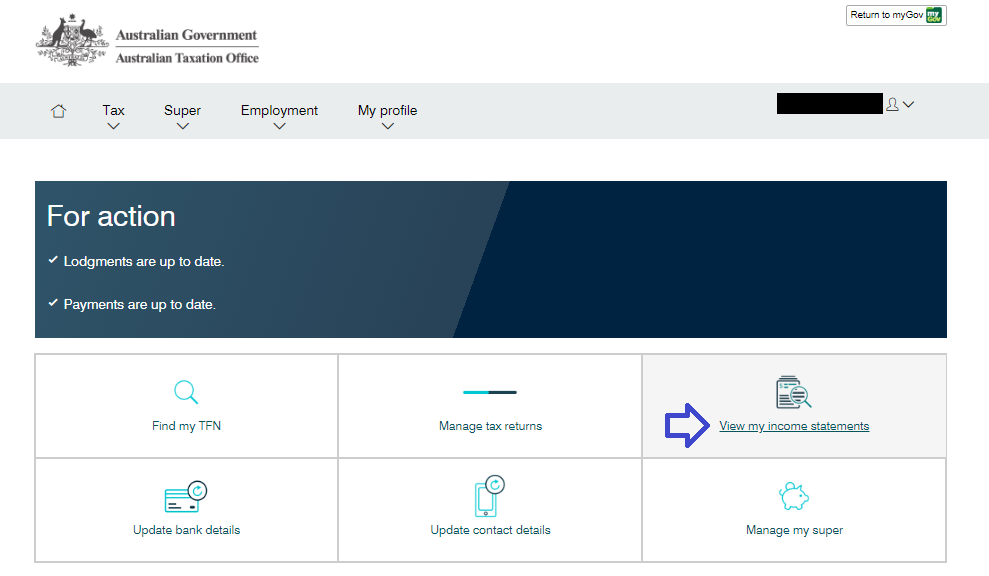

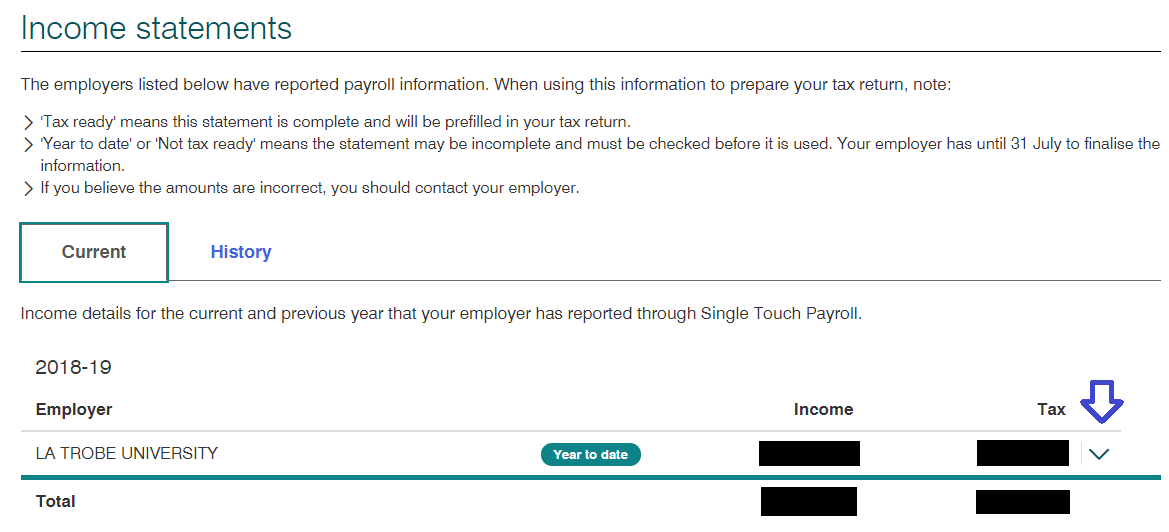

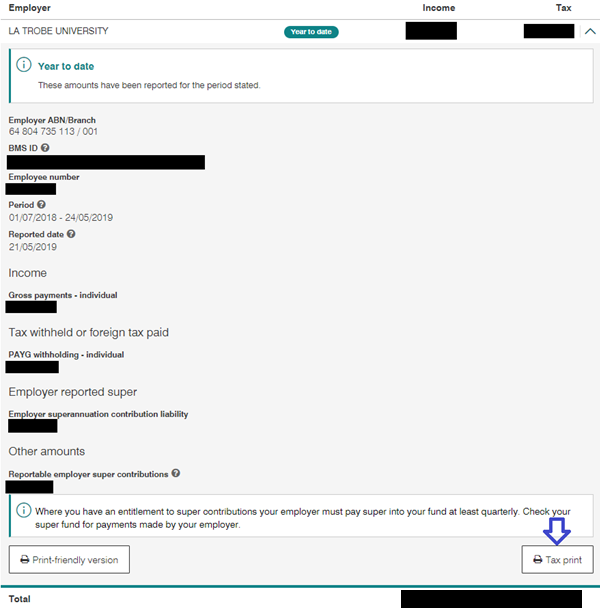

Click on “View my Income Statements” from the main screen, alternatively “Employment” and “Income Statements”

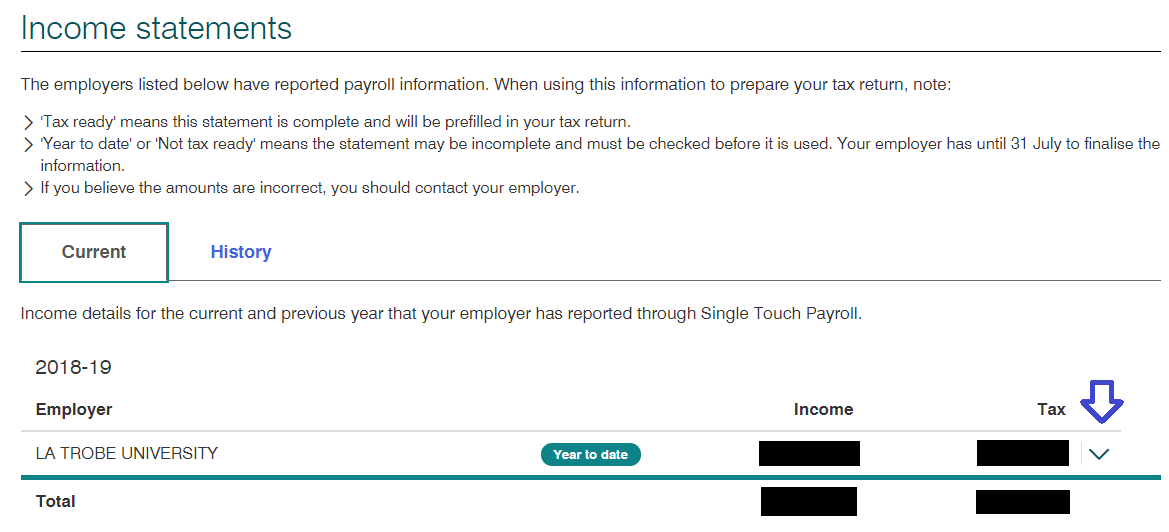

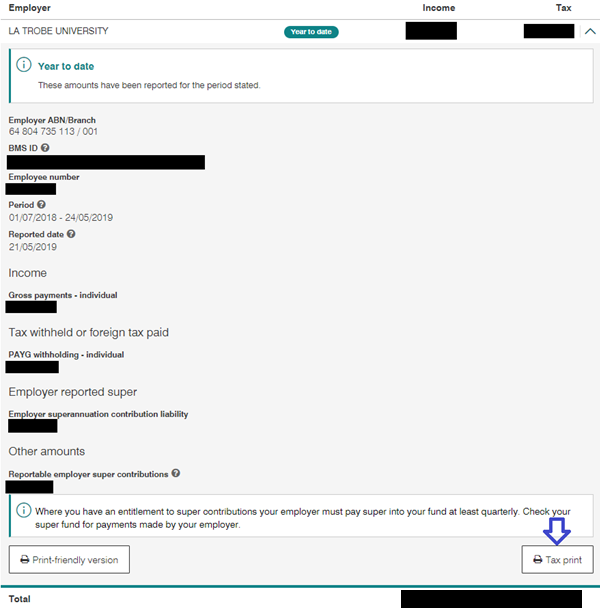

Your income for the financial year-to-date will be displayed, and the tax that has been withheld. You can view more details by clicking the arrow

You can print a copy of your detailed tax return by click “Tax Print”

Note:

- ‘Tax ready' means this statement is complete and will be prefilled in your tax return.

- 'Year to date' or 'Not tax ready' means the statement may be incomplete and must be checked before it is used.

- La Trobe will finalise your income statement for it to be ‘tax ready’ by the 14th July.

What if I don’t want to have a myGov account?

It is not compulsory to have a myGov account. If you don’t create one you will need to contact the ATO on 13 28 61 to request your income statement.

Your registered tax agent will be able to access your STP information.

What if I am no longer employed at the university?

Due to this legislative change the University is no longer required to issue a payment summary for the financial year 2018/2019 onwards. This information will be available in your myGov account and will be called an income statement. If you do not have a myGov account you can create one. Alternatively if you do not wish to create a myGov account you will need to contact the ATO on 13 28 61 to request your income statement. Historical payment summaries will still be available on request from HR Assist, please call 03 9479 1234 to validate your identity and provide an email address or email hrassist@latrobe.edu.au with your contact details.

When will I be able to view my updated details via myGov?

Each time La Trobe pays you, your year-to-date Salary, Tax and Superannuation information will be updated in myGov. This information is may take a few days to update with the ATO, meaning there can be a slight delay between you payslip year-to-date and your ATO records.

Where do I get my payment summary?

Historical payment summaries prior to and including 2017/2018 will be available via MyHR. From 2019 your ‘income statement’ will be available in your myGov account. If you do not have a myGov account you can create one. Alternatively if you do not wish to create a myGov account you will need to contact the ATO on 13 28 61 to request your income statement.